International Remittance Service

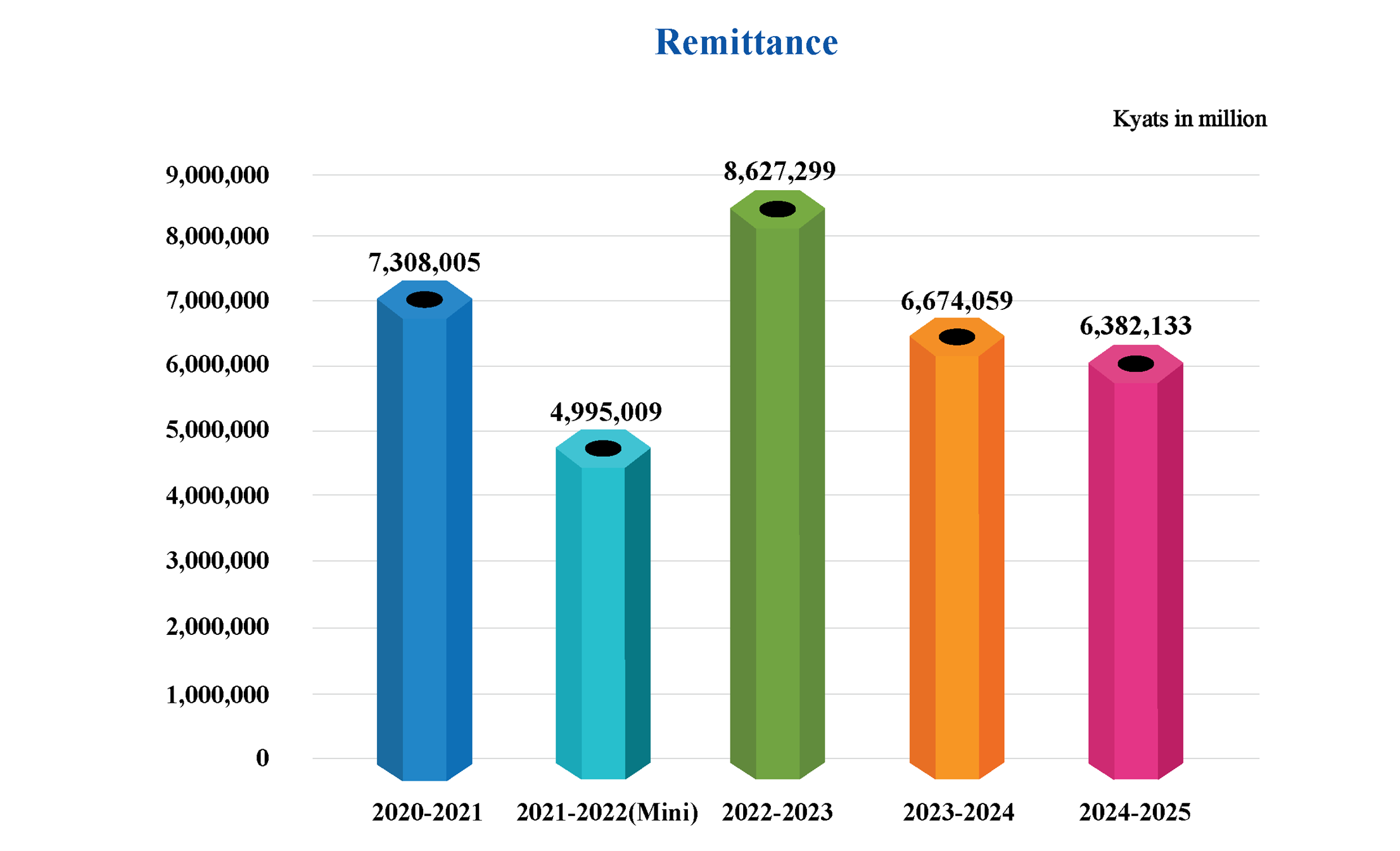

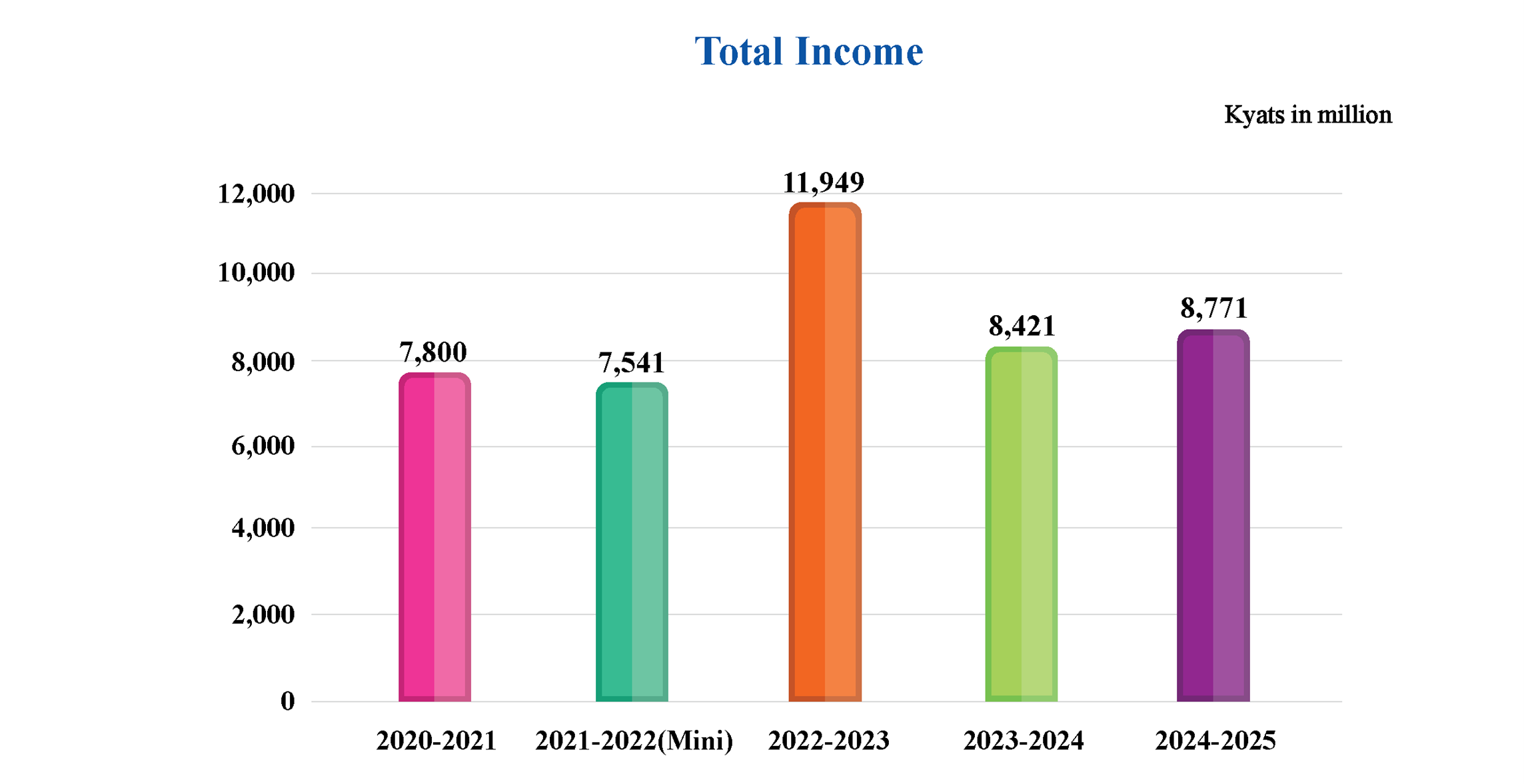

To enable Myanmar Citizens working abroad and others staying abroad for various reasons to do the remittance, we have been cooperating with Western Union which is carrying out the international remittance activities with more than 200 countries.By virtue of cooperation on the part of Western Union, the foreign currencies remitted from abroad can be withdrawn in all GTB branches including the Head Office within minutes. Additionally, we can also transmit the outbound to over 200 countries through Western Union. Efforts are also being made to promote cross border trade with Thai, China and India to facilitate the activities in border import and export activities.